Following our February article “Watching Fed’s Move as US Economic Data Turns”, it is generally believed that the Fed is going to stop raising interest rates for a while, with recent developments, it is likely for the Fed to even consider a rate cut instead of further rate hike. The market suffered further turmoil at the end of March as the US yield curve inverted for the first time since 2007. With all these major economic headlines, we would like to discuss in this article that how would the Fed-dovishness affect the US consumer behaviour, also, if the inverted yield curve really suggests any signal of recession ahead.

The US consumer activities in the Fed’s patient mood

Following the US Federal Reserve’s decision on March 20, which is to refrain from raising interest rates for the rest of this year and stop shrinking its balance sheet soon, yields on US benchmark bonds have fallen steeply, followed by the 3-month and 10-year yields inverted at the end of the same month.

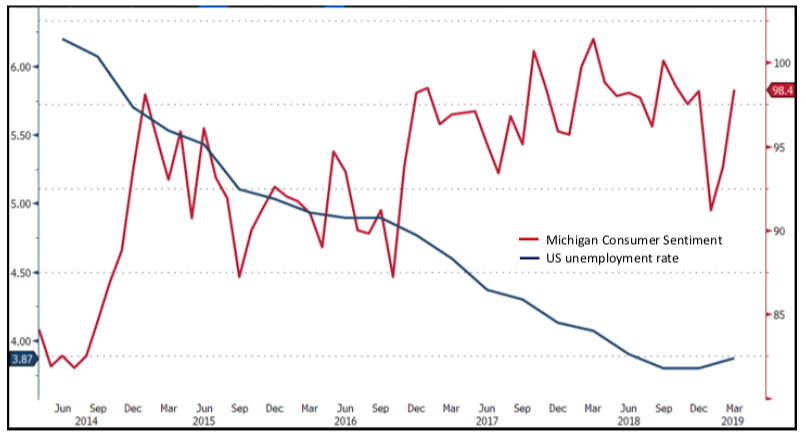

However,US consumer sentiment measured by the University of Michigan’s preliminary March sentiment index remains elevated and rose more than expected. The strong print has little to do with the Fed’s recent change of attitude on rate decision but reflects a sizable jump in income expectations, as the US Labour Department figures shows that average hourly earnings in March rose by the most since 2009. Job prospects, wages and the overall labour market have more impact on consumer attitudes than any other factor, and the US labour market has had its best performance in over three years in the past 12 months.

The positive momentum of US consumer sentiment echoes our previous study that personal consumption in the US shall continue to expand in 2019, we can then expect that consumer loan balance, which is highly correlated to consumer spending, will maintain its uptrend.

University of Michigan’s Consumer Sentiment Index, US Unemployment Rate

Source: Bloomberg, University of Michigan’s Consumer Sentiment, US Labour Department

The uniqueness of consumer credit

What’s so special about consumer confidence and consumer credit are, they show sensitivity to broad trends impacting consumer health, such as unemployment, economic cycles and recessions rather than the changes in interest rate. The Fed’s attitude affects the performance of traditional fixed income instruments susceptibly but not to consumer credit.

Secondly, since the size of each consumer loan is relatively small comparing with other fixed income vehicles, if one decides to include consumer credit into the investment portfolio, diversification can be achieved with no sweat. Furthermore, since the repayment of consumer loan generally happens on monthly basis, it shortens the duration of the investment significantly. Beyond doubt, the shorter the duration of an investment is, the less sensitivity of that investment to interest rate environment can be.

The factors affecting US consumer credit performance

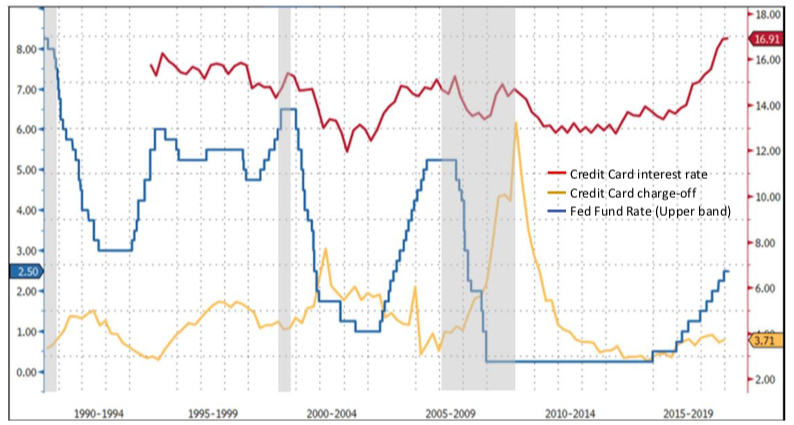

While we would like to understand more about the performance of this sector, we take a closer look at the interest rate history of US credit card, which represents how the US consumers being charged for their spending supported by debt.

There were little changes with the credit card interest rate at the times that the Fed maintained the Fed Fund Rate stable, and even for the times that the Fed was cutting rate, the slope of interest rate downtrend is less steep than the Fed Fund Rate curve. The charge-off of the credit card debt, on the other hand, shows nearly no correlation with the Fed Fund Rate movement, except for the recession periods which are highlighted in grey as shown in the graph below. Empirically, we can conclude that the trend of basis between credit card interest rate and charge-off does not respond to the Fed Fund Rate changes.

US Credit Card Assessed Interest Rate, Charge-off and Fed Fund Rate (Upper Band)

Source: Bloomberg,Federal Reserve Bank

Any sign of recession ahead?

What we should care more about is whether or not, or the likelihood of a recession around the corner, as clearly the charge-off of consumer loan only spikes whenever a recession occurs. By the nature of interest rate, yields are normally higher with longer maturity dates, a result of the value of an underlying is more unpredictable over a longer time horizon. What worries us is from history we learnt that when an economy is heading to a recession, knowing that interest rates are to trend lower, investors are more willing to invest in longer-term instruments immediately to lock-in current higher yields, so that boosts the prices and further lowering the yields. The eagerness for longer-term investment will suppress the demand for shorter-term ones of the same credit quality, which might lead to a rare yield curve type – inverted yield curve.

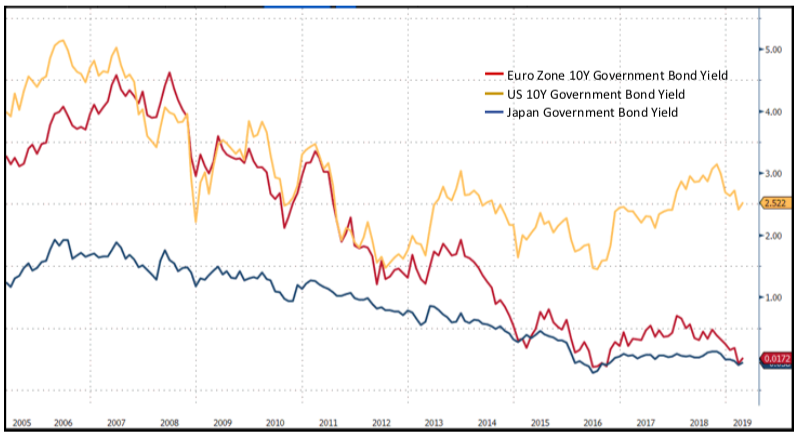

However, the inverted yield curve which happened last month might tell a different story. The shape of the yield curve nowadays might no longer be a reliable indicator to a halt or a recession ahead, as major central banks such as the Fed, ECB and BoJ have already injected massive liquidity into the economies, causing the long-term interest rate compressed, and Ultra-low bond yields in Japan and the Euro Zone are acting as an anchor, further pulling Treasury yields down. We therefore expect little likelihood of recession in the US but agree on Former Fed Chair Yellen’s earlier comment that there’s a tendency now for the yield curve to be very flat.

US, Japan and Euro Zone Bond Yield

Source: Bloomberg