Diversification is crucial to a well-balanced optimized portfolio. Many investors typically invest in traditional asset classes such as stocks and bonds; however, alternative asset investment has picked up over the last decade due to its valuable contribution to portfolio diversification.

US consumer loans, a subclass of alternative assets, have seen a particularly swift increase in institutional investment. The US unsecured personal loan market hit an all-time high in 2018, rising 17% year-on-year to $138 billion, according to data from TransUnion, an American consumer credit reporting agency.

The recent growth of investment in the US consumer loan asset class has been driven in part by the attractive risk/reward characteristics of alternative lending and the stable returns it generates.

Defining Consumer Loans

Consumer loans are personal debts taken to buy goods and services for personal, family, or household needs. Most commonly, banks use credit cards as a means to provide capped lending services to borrowers for ordinary expenses. Some borrowers may then seek alternative loans to consolidate debt or pay down revolving credit balances. By moving from a revolving structure to an amortizing instalment structure, borrowers may benefit from lower interest rates.

Alternative lending platforms streamline the traditional lending process by directly connecting borrowers with loan investors and optimizing loan pricing models through technology-enhanced borrower credit risk analysis engines. These firms typically offer more attractive borrowing rates than traditional banks who must also incorporate costly branch network operations overhead into their pricing model.

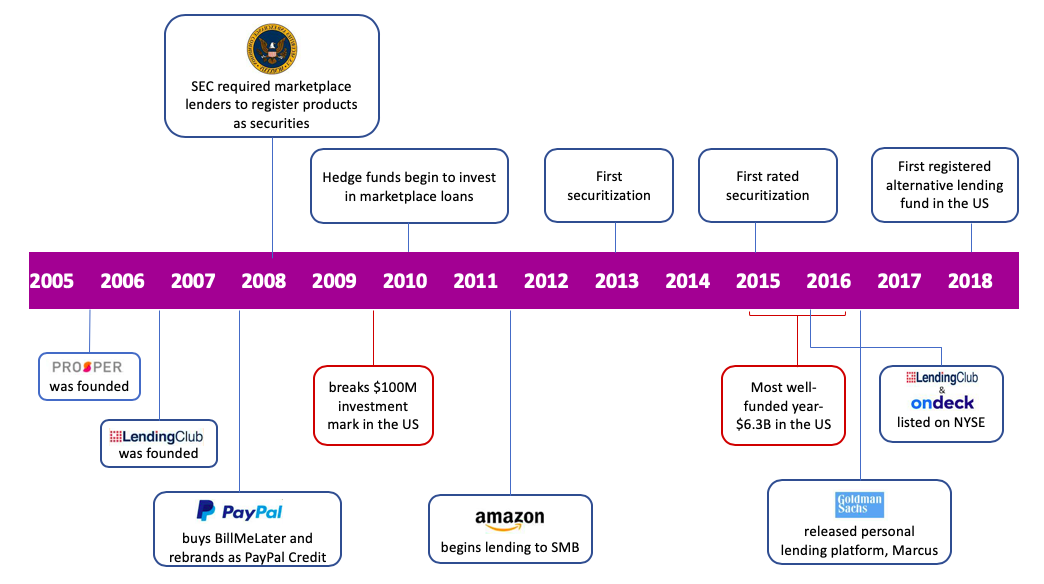

US Marketplace Lending Development Timeline

Source:CB Insights, FinEX Asia

Why Invest in US Consumer Loans?

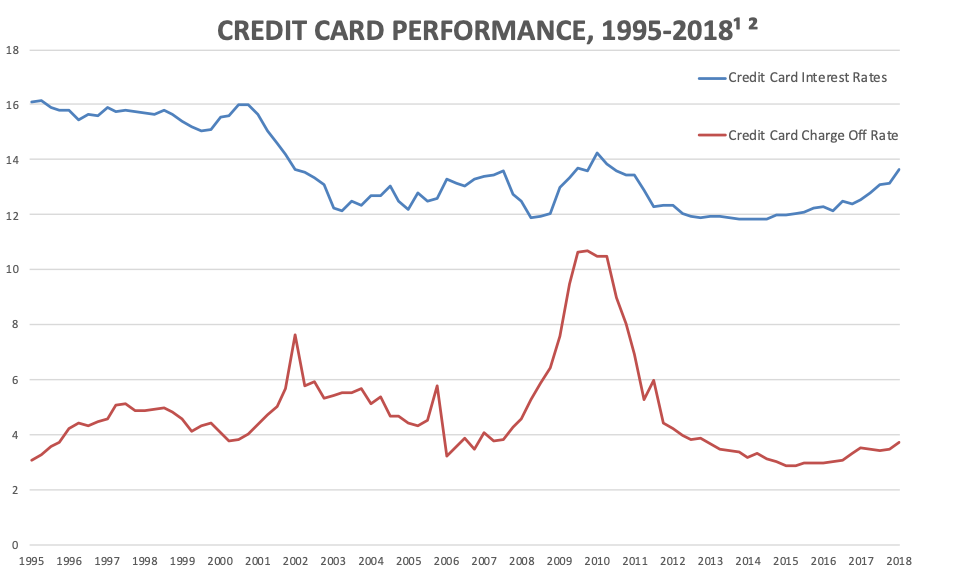

Credit plays an important role in the US economy and its growth significantly impacts bank health. Given credit’s significance to the US economy, the Fed requires issuers to publicly state the interest and default rates of bank-issued credit cards.

The chart below shows the high profit margins that banks earn on consumer credit. Even throughout the financial crisis of 2008, issuers have consistently profited. As the economic environment improves and consumers are more inclined to spend, demand for credit has grown.

US consumer lending is a US$4 trillion industry that is becoming increasingly disrupted by fintech firms who provide unsecured consumer credit products to non-bank investors. The stability of its returns, driven by monthly loan interest payments, and its ability to reduce overall risk and volatility in an investment portfolio have led institutions like Soros and Blackrock to venture into the asset class.

As credit volumes ramp up and the industry continues to mature, alternative lending platforms now compose approximately 38% of the US personal loanmarket – significantly higher than 5% in 2013. Most loans are currently funded by institutional investors.

Source:The Federal Reserve

How Do US Consumer Loans Compare with Other Asset Classes?

While investment objectives vary by risk appetite and time horizon, investment diversification is universally important to investors of all backgrounds. Diversification is the practice of investing in a broad spectrum of asset classes and industries to limit risk exposure and reduce portfolio volatility over time.

Consumer credit provides additional diversification against other major asset classes – including traditional fixed income. The underlying credit exposure is primarily based on consumers rather than corporates or government, which has historically driven a low correlation between consumer credit and other asset classes. Furthermore, consumer credit is generally priced at a variable rate and amortizes monthly, which differentiates it from commercial loans and bonds that tend to be fixed-rate instruments repaid in a single lump sum upon maturity.

US consumer loans represent a significant asset class on bank balance sheets and are highly regulated by numerous US federal agencies. The US credit market is also unique in that borrowers are graded on their creditworthiness as defined by Fair, Isaac and Company (“FICO”) scores. FICO scores are used by lenders to determine which consumers qualify for which loans at what rate. Therefore, the US credit market is mature with in-depth historical data that can be analysed for powerful insights into loan performance and risk.

What Are the Returns?

As shown in the graph above, banks have consistently profited from credit. Even in times of economic downturn like the financial crisis of 2008, banks still realized 2-3% profit margins from their consumer credit business lines.

The emergence of alternative lending platforms has opened up industry access for investors seeking opportunities to invest in consumer credit assets. Ordinary investors can average 5.49% annualized returns from platforms like Lending Club while investment managers like Hong Kong-based asset management startup,FinEX Asia, can leverage carefully structured active buying strategies to achieve 7-8% annualized yields.

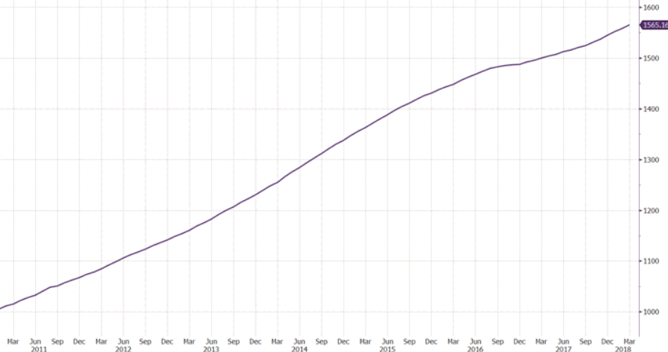

Consumer credit yields are typically more stable than equity or traditional fixed income investments and are generally resistant to market volatility brought on by turbulent events like Brexit, general elections, etc. Higher market volatility of bond and equity investments is evident when comparing to US online lending performance indicators like the Orchard Index.

Orchard US Consumer Marketplace Lending Index

Source: Bloomberg

How Do You Access the Asset Class?

The US consumer loan market historically bears a high barrier of entry for Asian investors. FinEX Asia has addressed this issue by developing easily investable US consumer loan fund productsthat enable access to this asset class.

FinEX Asia is widely acclaimed for its industry-leading fixed income funds and its credit funds are attracting significant investment from financial institutions, corporates, insurers, wealth managers, and private individuals. Notably, the FinEX Marketplace Credit Fund has achieved a 7.39% yield per annum since inception in October 2017 with extremely low volatility of 0.45% ITD.

FinEX Asia is registered under SFC license# AFQ783 and currently holds over US$260 million in assets under management.

More information on FinEX Asia’s US marketplace credit funds can be found here.